Investors had a healthy appetite for risk so far this year as a so-called potential soft landing has been factored in. We have an economy with rising wages, decelerating inflation, and a Federal Reserve (Fed) on the cusp of cutting rates. What more could you ask for? Of course, political uncertainty and headwinds from geopolitical risks could rain on that parade, and that’s why investors should exhibit discernment in a market like this.

KEY THEMES FOR THE REST OF THE YEAR

- As we prepare for what’s ahead, the domestic economy looks to be late cycle, and recent data suggests the consumer is becoming a bit more selective on how and where to spend.

- We expect economic activity to downshift later this year as data from both the Conference Board and the University of Michigan revealed that most consumers have pivoted away from big-ticket buying plans.

- These changes in buying plans could have knock-on effects in other categories of the economy, such as housing. The geographic reshuffling may be over in earnest as opportunities for remote work are likely shrinking in response to an overall cooling of the labor market and as corporate policies are getting less flexible on work arrangements.

- But so far, risk appetite is elevated given investors’ expectations that the Fed will start cutting rates soon.

LET THE GOOD TIMES ROLL…BUT FOR HOW LONG?

Investors recently responded favorably to current conditions and put more risk in their portfolios. The latest data show inflation rose a mere 0.07% as goods prices declined 0.17% but were offset by services prices up by 0.20%. Inflation continues to moderate and is slowly approaching the Fed’s target and giving the markets some confidence that the Fed will begin cutting rates at the September meeting.

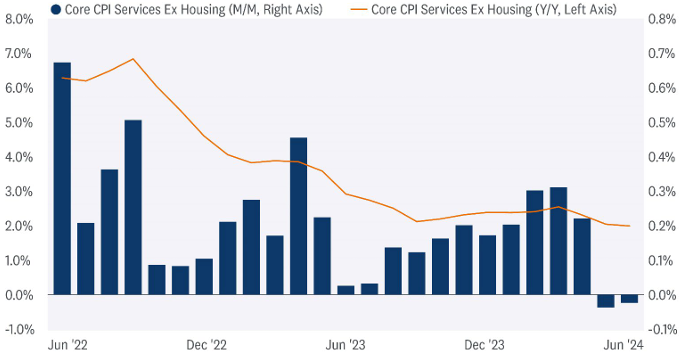

Looking deeper into the data, there are a few bright spots. Rent prices rose 0.26% month-to month, back to pre-pandemic averages, and prices on goods declined for the second consecutive month as consumers showed less demand for goods purchases. Services prices are moderating as most services ex-housing have eased or outright declined.

STICKY SERVICES INFLATION TURNED A CORNER

Source: LPL Research, Bureau of Labor Statistics, 07/29/24

Inflation continues to moderate and is slowly approaching the Fed’s target. At the upcoming Fed meeting, we should expect the Fed to highlight the slowdown in hiring as one reason to cut rates at the September meeting. As it relates to business activity, real disposable income per capita continues to rise, giving consumers the ability to keep spending despite high price levels. So, we are paying more, but we are getting paid more.

Leading indicators for services inflation suggest the deceleration should continue. The Employment Cost Index (ECI), a comprehensive measure for labor costs, indicates further deceleration in inflation.

EASING LABOR COSTS WILL FURTHER DAMPEN SERVICES INFLATION

Source: LPL Research, Bureau of Labor Statistics, 07/29/24

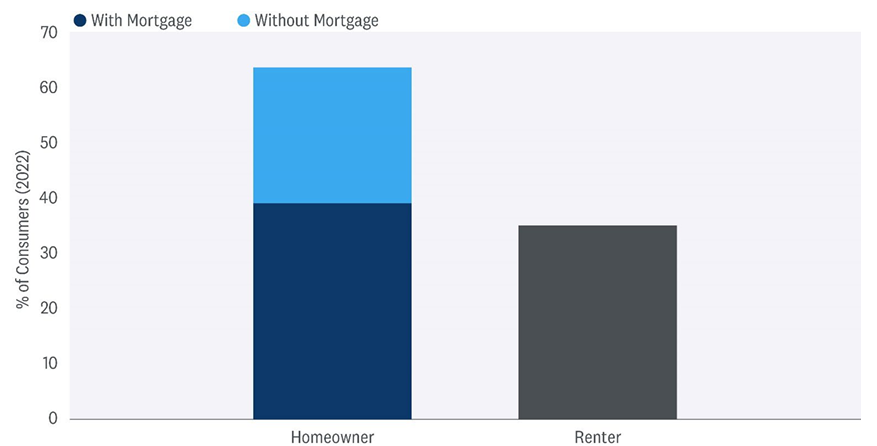

LESS RATE SENSITIVE

As the population ages, the economy becomes less interest rate sensitive, and this is likely one area of concern for policy makers. At the upcoming summer conference in Jackson Hole, Wyoming, the Fed will reassess monetary policy after experiencing such a long period where higher interest rates have not created as much pain as anticipated. The Jackson Hole Symposium for global central bankers is titled “Reassessing the Effectiveness and Transmission of Monetary Policy” and hints at the policy challenges in a post-pandemic world. This event will be very important as we expect Fed Chairman Jerome Powell and other leaders to talk more and more about the challenges of monetary policy in a world less sensitive to interest rates.

One of the Fed’s monetary tools involves setting the federal funds rate, an interest rate that influences other market rates such as bank loans, CD rates, and mortgage rates. Typically, higher rates will slow the economy and release some of the pressure on consumer prices. But that hasn’t happened, at least not uniformly across the economy, nor at the same magnitude as previous years. One reason some parts of the economy appear immune to high rates is the growing percentage of homeowners who either don’t have a mortgage at all or have a mortgage they refinanced in 2020 or 2021.

MORE CONSUMERS WITHOUT MORTGAGES MAKE THE ECONOMY LESS INTEREST RATE SENSITIVE

Source: LPL Research, Bureau of Labor Statistics, 07/29/24

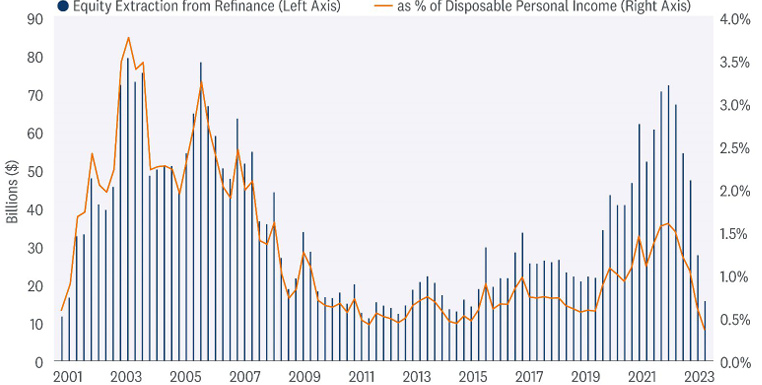

WE HAVE A DELAYED LANDING…BUT STILL A LANDING

Recent data on refinancing activity provides a clue on why the economy has experienced a delayed landing. The housing market often explains a lot of what is happening in other sectors of the economy, and this time is no different. Roughly one-third of mortgages were refinanced in the quarters following the pandemic recession of 2020.1 And because of 2020’s extremely low mortgage rates, these homeowners lowered their monthly payments, thereby increasing their disposable income. Other homeowners took advantage of healthy home equity and took cash out to support more spending.

BILLIONS IN TAPPED HOME EQUITY SPURRED SPENDING

Source: LPL Research, New York Fed Consumer Credit Panel, Equifax 07/29/2024

The incredible impact of such historic refinancing activity caught many, including us, by surprise. In addition to the oft-mentioned excess savings from stimulus, improved household financial conditions from low mortgage rates kept the economy out of the doldrums. As we look ahead, however, the domestic economy looks to be in a late cycle, and recent data suggests the consumer has started to slow down. We indeed expect the consumer will slow spending later this year as data from both the Conference Board and the University of Michigan revealed that most consumers have pivoted away from big-ticket buying plans. These changes in buying plans could have knock-on effects in other categories of spending. Investors should anticipate a forthcoming downshift in consumer activity.

1https://libertystreeteconomics.newyorkfed.org/2023/05/the-great-pandemic-mortgage-refinance-boom/

ASSET ALLOCATION VIEWS

The LPL Strategic and Tactical Asset Allocation Committee (STAAC) maintains its recommended neutral equities allocation amid a favorable economic and profit backdrop. Interest rates may need to fall for valuations to hold, so potential second-half gains are more likely to be driven by earnings growth. The Committee remains comfortable with a balanced approach to market cap. High-quality small cap stocks are attractively valued, but the earnings power among large cap companies overall, has been very impressive. The Committee maintains a slight preference towards large cap growth. Artificial intelligence (AI)-fueled earnings growth, potentially lower interest rates as the economy slows, and our technical analysis work favors the growth style. Finally, the STAAC’s regional preference remains U.S. over developed international and emerging markets (EM) due largely to superior earnings and economic growth in the U.S.

The STAAC continues to recommend a modest overweight to fixed income, funded from cash, with a strong overweight tilt in preferred securities as valuations remain attractive and a recommended neutral duration posture relative to benchmarks. The risk/reward for core bond sectors (U.S. Treasury, agency mortgage-backed securities (MBS), investment-grade corporates) is more attractive than plus sectors.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

RES-0001517-064W | For Public Use | Tracking # 608352 (Exp. 07/2025)